Many startups have been conditioned to think venture capital (VC) is the best source of funding. While venture capital has its benefits, it may not be the right method of fundraising for your business.

Many startups have been conditioned to think venture capital (VC) is the best source of funding. While venture capital has its benefits, it may not be the right method of fundraising for your business.

In a recent webinar, Josh Amster, StartEngine’s VP of Sales, dove into the differences between venture capital (VC) and equity crowdfunding (ECF), comparing each method’s strengths and weaknesses to help clarify which funding pathway is right for you.

Watch the recording and read a recap of the webinar below:

Investment Activity Today

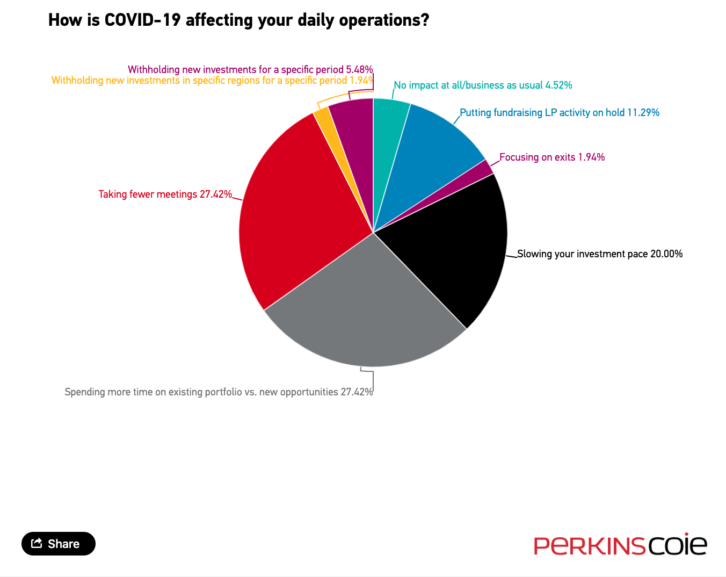

To start, it’s important for entrepreneurs to understand how investors are reacting to the COVID-19 pandemic. In the VC space, we’ve seen a considerable drop in startup valuations. VCs are also taking fewer meetings and investing in fewer deals. Some VCs are even ceasing all new investment, choosing instead to distribute capital across their existing portfolios to keep those businesses alive.

This is reflected in the chart below, which shows how VCs have been affected by COVID:

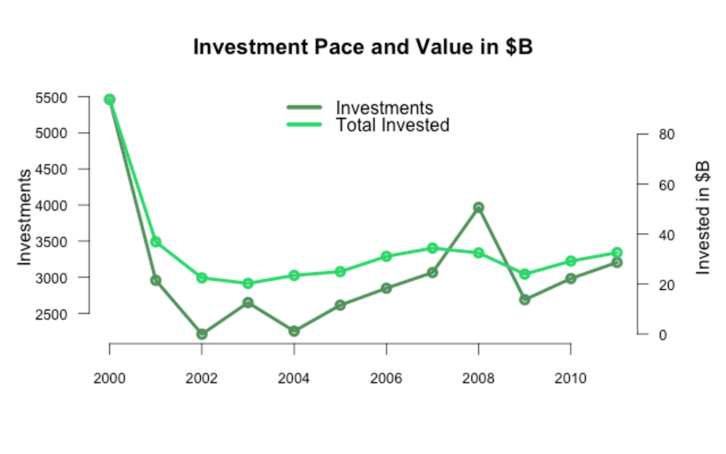

This dual decrease in the total amount invested and volume of deals made has also occurred in the past two economic recessions (the dot-com crash of 2001 and the housing crisis of 2008):

Equity crowdfunding activity tells a very different story. Using our own data, the average daily amount raised on StartEngine has steadily increased more than 4x since the pandemic began, and we believe is showing no signs of slowing down. “The demand is… as high as it’s ever been,” Amster said. “Companies are hungry for capital and there’s less investment out there available to them.”

Deal Flow

Another key area to compare venture capital and equity crowdfunding is deal flow. The roughly 1,000 VC firms in the US made 11,000 investments in 2019 (2,500 of which were late-stage deals). Considering there are 5M small businesses in the US, that means only a small fraction of business secure VC funding. “[There is] extreme selectivity on the venture capital side, and most entrepreneurs are shut out of being able to secure a VC investment,” Amster pointed out.

On the other hand, the 54 equity crowdfunding funding portals in the US hosted 735 Reg CF offerings in 2019, of which 143 were StartEngine campaigns. While the total number of crowdfunding campaigns is still far lower than the number of VC investments, the annual number of deals per platform exceeds the number of VC investments per firm (13.6 vs. 11) – meaning StartEngine’s 143 campaign count is over 10x the average annual number of campaigns per platform.

When also considering that equity crowdfunding hasn’t existed as a fundraising option for nearly as long as venture capital, we expect to see this gap widen as more platforms crop up and expand their capacity.

From a geographical perspective, 80% of VC money goes to companies in the five largest metro areas, compared to only 42% of equity crowdfunding capital, indicating that equity crowdfunding creates more equitable access to capital for companies in all areas of the country.

When it comes to the gender gap, only 11.5% of VC money went to companies with a female cofounder, while 27.9% of crowdfunding capital went to companies with a female cofounder. While we’re proud to be contributing to this positive change, we know it’s still not where it needs to be. “Entrepreneurs of any kind should be able to get access to capital,” Amster stated.

Deal Size

Entrepreneurs and founders have been trained to believe they should follow a certain fundraising progression. While we believe startups should “Always Be Raising”, they can still follow something similar to the “traditional” process with equity crowdfunding, as deal sizes tend to be comparable.

The average VC seed round weighs in at about $1.7M, while the average VC Series A is $15.6M. This can easily be replicated with equity crowdfunding, where companies raise an alternative to pre-seed and/or seed rounds under Reg CF for up to $5M (once the maximum is raised from the current cap of $1.07M), followed by an alternative Series A via Reg A+ for $10M-$15M (out of a possible $50M, which should increase to $75M in the near future).

Strengths & Weaknesses

Of course, venture capital and equity crowdfunding each have positives and drawbacks. Let’s explore them.

Venture Capital Pros

- Deep pockets – With hundreds of millions (if not billions) of dollars to deploy, VCs offer startups a large amount of capital very quickly

- Experience – As a more established form of capital investment, VCs have years of experience guiding high-growth companies

- Network – VCs have access strategic connections and valuable resources

- Validation – companies that secure capital from a reputable firm gain immediate credibility and prestige

Venture Capital Cons

- Exclusivity – Less than 1% of companies get VC funding

- Valuation – VCs put significant downward pressure on startup valuations to increase their upside

- Control – VCs seek advantageous terms (like board seats, preferred shares and anti-dilution protections, among others) to gain control at the expense of founders, which can lead to scenarios where the founders are forced out against their will

- Pressure – In order to generate a quick exit scenario that will bring returns to their portfolio, VCs push startups to grow at unsustainable and unhealthy levels

Equity Crowdfunding Pros

- Control – Companies usually offer non-voting, common shares via equity crowdfunding, allowing founders to maintain control of the company

- Brand Ambassadors – Equity crowdfunding allows startups to build armies of hundreds (if not thousands) of investors, who then become customers and brand champions

- Exposure – By marketing their equity crowdfunding campaigns, companies reach new audiences

- Sales – Companies can increase sales by offering investment perks like discounts

- Steady Capital – Equity crowdfunding allows companies to always be raising, rather than raising capital in fits and starts

Equity Crowdfunding Cons

- No Guarantees – There is no certainty a company will meet its equity crowdfunding goal

- Disclosures – Because equity crowdfunding offerings are open to the public, companies must be transparent with financials and reporting

- Costs – There are legal, accounting, platform and marketing costs associated with equity crowdfunding campaigns

Conclusion

51% of companies that raise money on StartEngine return to raise another round of capital on the platform. “That speaks volumes to the benefits these entrepreneurs see in raising capital from the general public,” Amster said.

We see the benefits, too – so much so that we “eat our own dogfood.” In other words, we have repeatedly raised money for ourselves on our own platform – to the tune of over $20M from more than 10,000 investors over the course of four Reg CF and two Reg A+ raises, one of which is currently active.

“We want to maintain control of our company,” Amster said. “We believe in the benefits equity crowdfunding provides and we’re not interested in securing VC investment.” If you agree, you can apply to raise capital on the StartEngine platform today!

Q&A

After explaining the pros and cons, Josh opened the floor to questions. Here are a few highlights:

How does funding raised on StartEngine break down by sector?

In the early days, consumer-facing companies had the most success with equity crowdfunding. It’s easy for these companies to go to their existing customer base to become investors. Since then, the industry has matured. Now, we’re seeing companies with compelling missions have success, whether they’re consumer-facing or B2B – as long as a company can show the public why they make a great investment opportunity.

When do StartEngine investors have the opportunity to sell their shares?

Reg CF securities are restricted from transfer for 12 months, after which they are freely transferable. Reg A shares are freely transferable immediately after the offering. StartEngine is planning to launch a secondary trading platform that may create liquidity opportunities for investors, as long as the company lists shares on the exchange and the seller is able to find a buyer at their desired selling price.

How does StartEngine value a company?

While there’s no single best way to set a valuation, the most common methods are revenue multiples, comparative analysis of similar companies in the industry, and discounted cash-flow analysis. StartEngine allows companies to set their own valuations (and provides collaborative guidance when necessary), but requires companies to provide a reasonable basis for their valuation..

To learn more about StartEngine’s offering, please view StartEngine’s offering circular and risks related to this offering. StartEngine is not accepting investment from Florida in this offering. To invest from Florida, please contact StartEngine directly at contact@startengine.com.

The StartEngine secondary market is still currently under development. There is no guarantee that development will ever be completed. Furthermore, if the development is completed, a company which intends to apply to list its securities on the marketplace will be subject to certain requirements which it may or may not be able to satisfy in a timely manner. Even if a company is qualified to list its securities on the market, there is no guarantee that a demand for these securities will exist. Even if a company does meet the requirements for listing its securities, we do not know the extent to which investor interest will lead to the development and maintenance of a liquid trading market. You should assume that you may not be able to liquidate your investment for some time or be able to pledge these shares as collateral.

StartEngine and its affiliates do not provide any investment advice or recommendation and do not provide any legal or tax advice with respect to any securities. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. StartEngine does not verify the adequacy, accuracy or completeness of any information. Neither StartEngine nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy, or completeness of any information on this site or the use of information on this site. See additional general disclosures here.