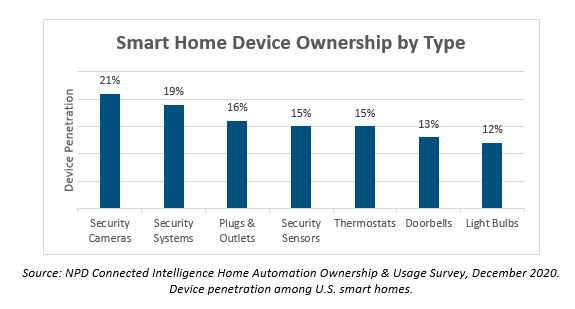

According to the latest Home Automation Ownership & Usage Report from NPD’s Connected Intelligence, half of U.S. consumers own at least one smart home device, up from 35% in January of 2020. While security cameras remain the most commonly owned smart home device, NPD’s Retail Tracking Service data reveals the largest sales gains in 2020 were seen in security systems (+44%), smart garage door openers (+21%), and smart lighting (+19%).¹

According to the latest Home Automation Ownership & Usage Report from NPD’s Connected Intelligence, half of U.S. consumers own at least one smart home device, up from 35% in January of 2020. While security cameras remain the most commonly owned smart home device, NPD’s Retail Tracking Service data reveals the largest sales gains in 2020 were seen in security systems (+44%), smart garage door openers (+21%), and smart lighting (+19%).¹

Security is a key motivator in smart home device purchases, and as such security cameras have been the leading volume driver for the past four years. In fact, they made up nearly one out of every four smart home device purchases at retail in 2020, the most of any device type. However, as many consumers shifted their focus to home projects during 2020 driven by pandemic restrictions, we saw growth in more convenience-driven categories. From January 2020 to October 2020 overall penetration in the smart lighting category grew from 8% to 12% driven in part by new smart homeowners (defined as those who purchased their devices from April-September 2020). Unit sales of smart lighting also saw strong gains up 43% in 2020 compared to 17% growth in 2019.

“While the pandemic played a role in sparking interest in additional smart home categories, the challenge to continue to grow the addressable market moving forward is in part average sales prices,” said Jill Aldort, director, industry analyst for The NPD Group in a statement. “Home automation ownership rates in households with an income of $150K+ are more than double those of under $45K income. As the landscape grows with new brands and new product lines from established brands, there could be opportunity for growth across a variety of categories at new price points.”

“While the pandemic played a role in sparking interest in additional smart home categories, the challenge to continue to grow the addressable market moving forward is in part average sales prices,” said Jill Aldort, director, industry analyst for The NPD Group in a statement. “Home automation ownership rates in households with an income of $150K+ are more than double those of under $45K income. As the landscape grows with new brands and new product lines from established brands, there could be opportunity for growth across a variety of categories at new price points.”

According to NPD’s Future of Tech report, smart home devices sales are forecasted to continue their growth in 2021, with sales up 9% over 2020. Some segments expected to drive the industry forward with at least twice that growth include smart locks, smart entry, and smart lighting.²

¹Source: The NPD Group, Inc., U.S. Retail Tracking Service. Home automation devices do not include Smart speakers.

²Based on forecasted sales of technology products captured in The NPD Group Retail Tracking Service point-of-sale data, Streaming Audio Speakers Total Market report, and Smartwatch Total Market report. This does not include mobile phones or gaming consoles.

Methodology

The NPD Group Connected Intelligence Home Automation Ownership & Usage Survey is based on consumer panel research that reaches over 5,000 U.S. consumers, aged 18+ from diverse regions and demographical backgrounds. The survey was fielded between October 9-29, 2020.

About Connected Intelligence

Connected Intelligence provides competitive intelligence and insight on the rapidly evolving consumer’s connected environment. The service focuses on the three core components of the connected market: the device, the broadband access that provides the connectivity and the content that drives consumer behavior. These three pillars of the connected ecosystem are analyzed through a comprehensive review of what is available, adopted, and consumed by the customer, as well as reviewing how the market will evolve over time and what the various vendors can do to best position themselves in this evolving market. For more information: http://www.connected-intelligence.com.

About The NPD Group, Inc.

NPD offers data, industry expertise, and prescriptive analytics to help our clients grow their businesses in a changing world. Over 2,000 companies worldwide rely on us to help them measure, predict, and improve performance across all channels, including brick-and-mortar, e-commerce, and B2B. We have services in 19 countries worldwide, with operations spanning the Americas, Europe, and APAC. Practice areas include apparel, appliances, automotive, beauty, books, B2B technology, consumer technology, e-commerce, fashion accessories, food consumption, foodservice, footwear, home, home improvement, juvenile products, media entertainment, mobile, office supplies, retail, sports, toys, and video games. For more information, visit npd.com.

See also: NPD Research: Installed TV Base Getting Bigger, Newer